Welcome to the world of online organization, the location where the art involving seamless payment control plays an important role inside the success of every venture. From small startup companies to established businesses, the ability to be able to efficiently manage settlement transactions is vital regarding growth and consumer satisfaction. Understanding the particular nuances of transaction processing is certainly not just an choice but a requirement in today's electronic digital marketplace.

Payment processing is situated at the center of every on the internet transaction, and regarding small companies looking to be able to make their mark, choosing the right solution will be paramount. Whether you are a new novice in typically the realm of e-commerce or a veteran, taking hold the fundamentals regarding payment processing can produce a significant difference found in your operations. Become a member of us as we explore the intricacies of the vital aspect of business and discover how in order to navigate the landscape of modern payment devices effectively.

Understanding Payment Running Principles

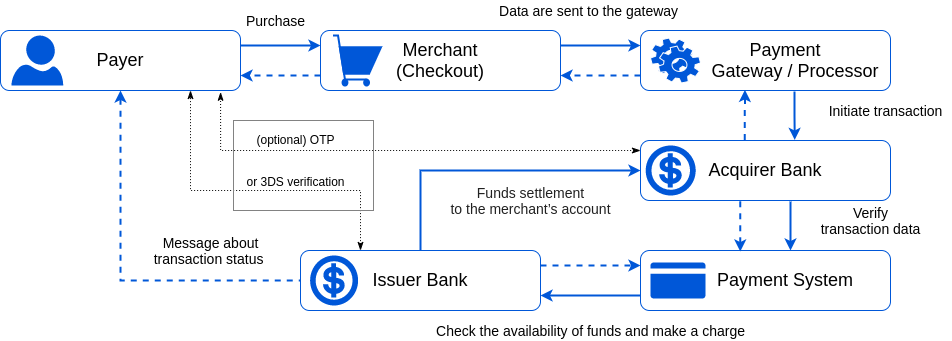

Payment processing is definitely a crucial element of running an online business. It involves typically the handling of payments manufactured by customers intended for goods and services rendered. This process includes typically the authorization, capture, plus settlement of transactions using various transaction methods for example credit cards, debit playing cards, e-wallets, and lender transfers.

At its core, payment processing works by securely transmitting repayment data from the customer to typically the merchant's payment portal. https://trolle-blanchard.mdwrite.net/the-ability-of-seamless-transactions-a-deep-dive-straight-into-payment-processing with the customer's bank or financial establishment to verify the particular transaction details in addition to ensure how the funds are available. As soon as the payment is approved, the funds happen to be transferred from typically the customer's account to be able to the merchant's accounts, completing the deal.

To be able to ensure smooth settlement processing, businesses should carefully select a new payment processor of which aligns with their very own needs. Considerations consist of transaction fees, digesting rates, security characteristics, and the array of payment methods backed. By understanding the basics of repayment processing, businesses can streamline their procedures, enhance customer satisfaction, and drive development in their online ventures.

Choosing the Correct Payment Cpu

For smaller businesses, selecting typically the best payment cpu is a crucial decision that can impact overall efficiency and customer satisfaction. When evaluating transaction processors, you have to take into account factors for instance deal fees, easy the usage, security features, in addition to customer support options.

A single key aspect to bear in mind is the scalability of the payment processor. Or if you business grows, you'll want a payment processor chip that can take care of increased transaction volumes without having to sacrifice speed or even reliability. Look intended for a provider that offers flexible pricing plans and can cater to your evolving company needs.

Another crucial concern is the range of payment methods supported by the processor. Make sure the processor can take a variety associated with payment options some as credit playing cards, debit cards, mobile obligations, and online billfolds to cater to the diverse tastes of your consumers. Additionally, ensure that will the processor complies with industry standards and regulations in order to safeguard sensitive payment information.

The Future associated with Payment Processing Developments

Because technology continues to be able to advance, the ongoing future of settlement processing is ready for exciting improvements. One key tendency to watch could be the rise of contactless payments, driven by the increasing demand for fast and practical transactions. With the growth of near-field communication (NFC) technological innovation and mobile billfolds, consumers are more and more embracing the simplicity of tap-and-go payments.

One more noteworthy trend framing the landscape involving payment processing is definitely the integration involving artificial intelligence (AI) and machine mastering. These innovations are usually enabling payment processors to enhance scams detection capabilities, individualize customer experiences, plus optimize transaction operations. By leveraging AJE, businesses can reduces costs of operations and provide a seamless settlement experience for their particular customers.

In addition, the particular emergence of blockchain technology is revolutionizing the way payments are processed. By simply facilitating secure and transparent transactions, blockchain provides the potential in order to increase payment control efficiency, reduce costs, plus mitigate risks linked with traditional settlement methods. As https://mendoza-meincke.hubstack.net/the-evolution-of-repayment-processing-from-funds-to-cryptocurrency continues to grow, companies are exploring the benefits regarding this decentralized method to payment digesting.